[ad_1]

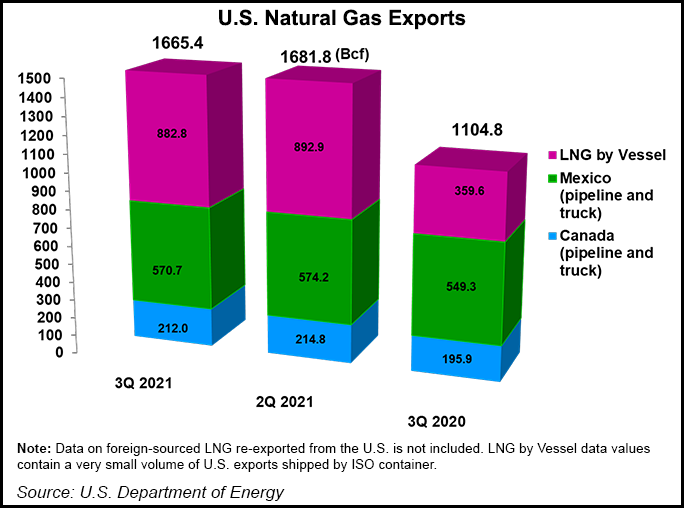

Prices jumped across the board in the North American natural gas market during the first nine months of 2021, according to the latest trade scorecard compiled by the United States Department of Energy (DOE).

U.S. exports to Mexico led the increases by scoring a 181% leap to a 2021 nine-month average of $5.48/MMBtu from $1.95 a year earlier, the DOE’s Gas Regulation division said.

Most natural gas contracts in Mexico are written based on U.S. prices with cost added for transportation into Mexico. However, momentum is growing for an independent Mexico-driven natural gas price index, according to market participants.

[In the Know: Better information empowers better decisions. Subscribe to NGI’s All News Access and gain the ability to read every article NGI publishes daily.]

Canadian sales in the U.S. gained 85% to $3.28 in the first three quarters of 2021, up from $1.77 in the same period of 2020.

Prices fetched by U.S. exports to Canada increased by 76% to a nine-month 2021 average of $3.31 from $1.88 a year earlier.

U.S. liquefied natural gas (LNG) exports had slower gains but stayed at the top of the price scale, climbing by 28% to $6.53 in the first three quarters of 2021 from $5.09 in the same period of 2020.

North American gas trade volumes increased across the board too.

The nine-month 2021 U.S. sales volume in Mexico rose by 11% to 1.6 Tcf, or 6 Bcf/d, from 1.47 Tcf, or 5.4 Bcf/d, a year earlier.

Mexico has become increasingly dependent on pipeline gas imports from the United States as state oil company Petróleos Mexicanos, aka Pemex, has struggled to maintain domestic output.

State power company Comisión Federal de Electricidad (CFE) has anchored the expansion of Mexico’s pipeline system to ensure U.S. gas supplies for the firm’s growing fleet of gas-fired power plants.

CFE has recently been engaging private sector firms such as Sempra and TC Energy Corp. to expand pipeline and LNG infrastructure further.

TC expects Mexico’s pipeline gas imports from the United States to reach 9 Bcf/d by 2030, up from around 6 Bcf/d currently.

American LNG stood out as the nine-month 2021 volume growth star, rising by 65% to 2.6 Tcf, or 9.6 Bcf/d. That compares with 1.6 Tcf, or 5.8 Bcf/d, for the same period of 2020.

U.S. LNG cargoes reached 38 countries. The top four tanker destinations – China, South Korea, Brazil and Spain – accounted for 56% of the shipments.

The DOE report comes as a wetter than average start to the Brazilian rainy season has dampened the country’s LNG demand of late.

Canadian pipeline deliveries to the United States increased by 12% in the first nine months of 2021 to 2.1 Tcf, or 7.9 Bcf/d, from 1.9 Tcf, or 7 Bcf/d a year earlier.

U.S. exports to Canada grew by 2% to a nine-month 2021 total of 681 Bcf, or 2.5 Bcf/d, from 665 Bcf, or 2.4 Bcf/d, in the same period of 2020.

The United States was a net exporter by a wide margin. Total international pipeline and LNG sales grew by 32% to 4.9 Tcf, or 18.1 Bcf/d, in the first nine months of 2021. This was up from 3.7 Tcf, or 13.6 Bcf/d, in the same period of 2020.

Total U.S. imports in the first nine months of 2021, almost entirely from Canada, were up by 11% to 2.16 Tcf, or 7.9 Bcf/d. In the year-earlier period, total imports were 1.95 Tcf, or 7.1 Bcf/d.

Andrew Baker contributed to this story.

[ad_2]

Source link