[ad_1]

This is the first publication of the Market’s Compass US Index and Sector ETF Study to be published in our Substack Blog that will highlight the technical changes of the 30 US ETFs that we track on a weekly basis. Past publications can be accessed via The Market’s Compass website or by contacting us directly.

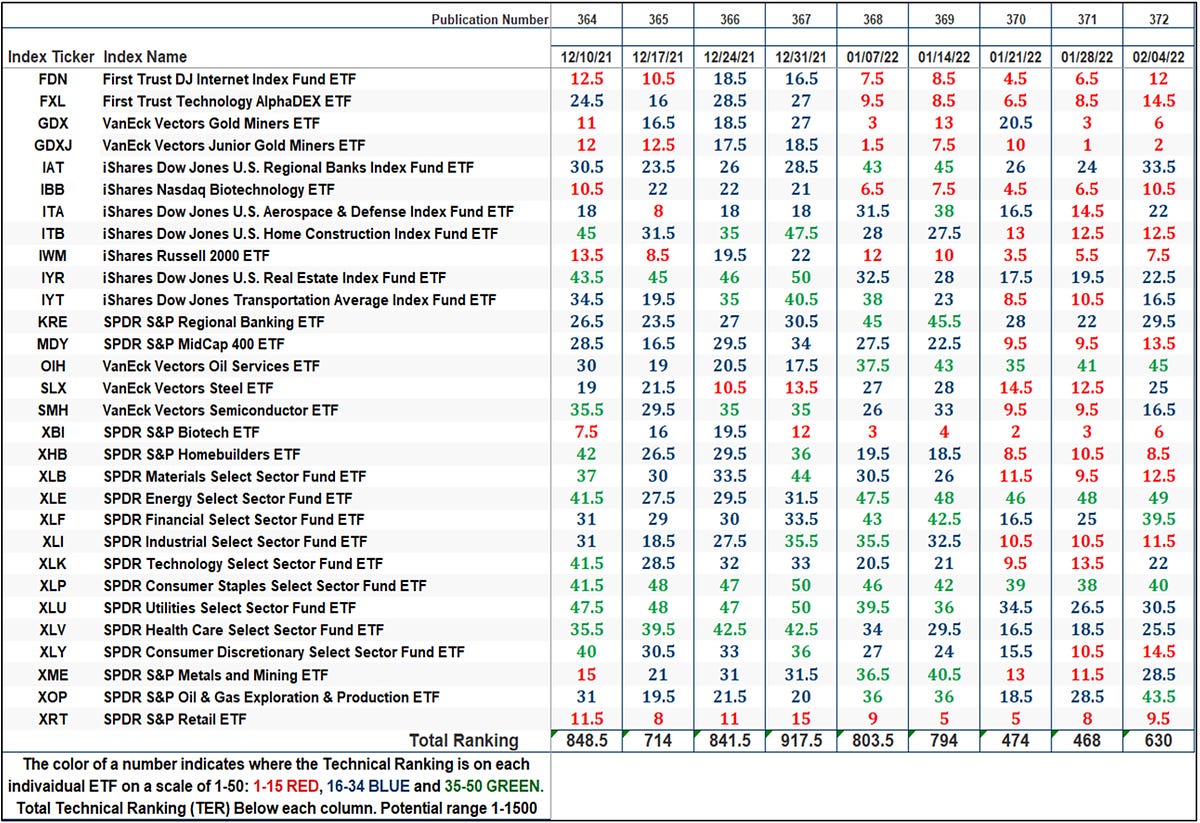

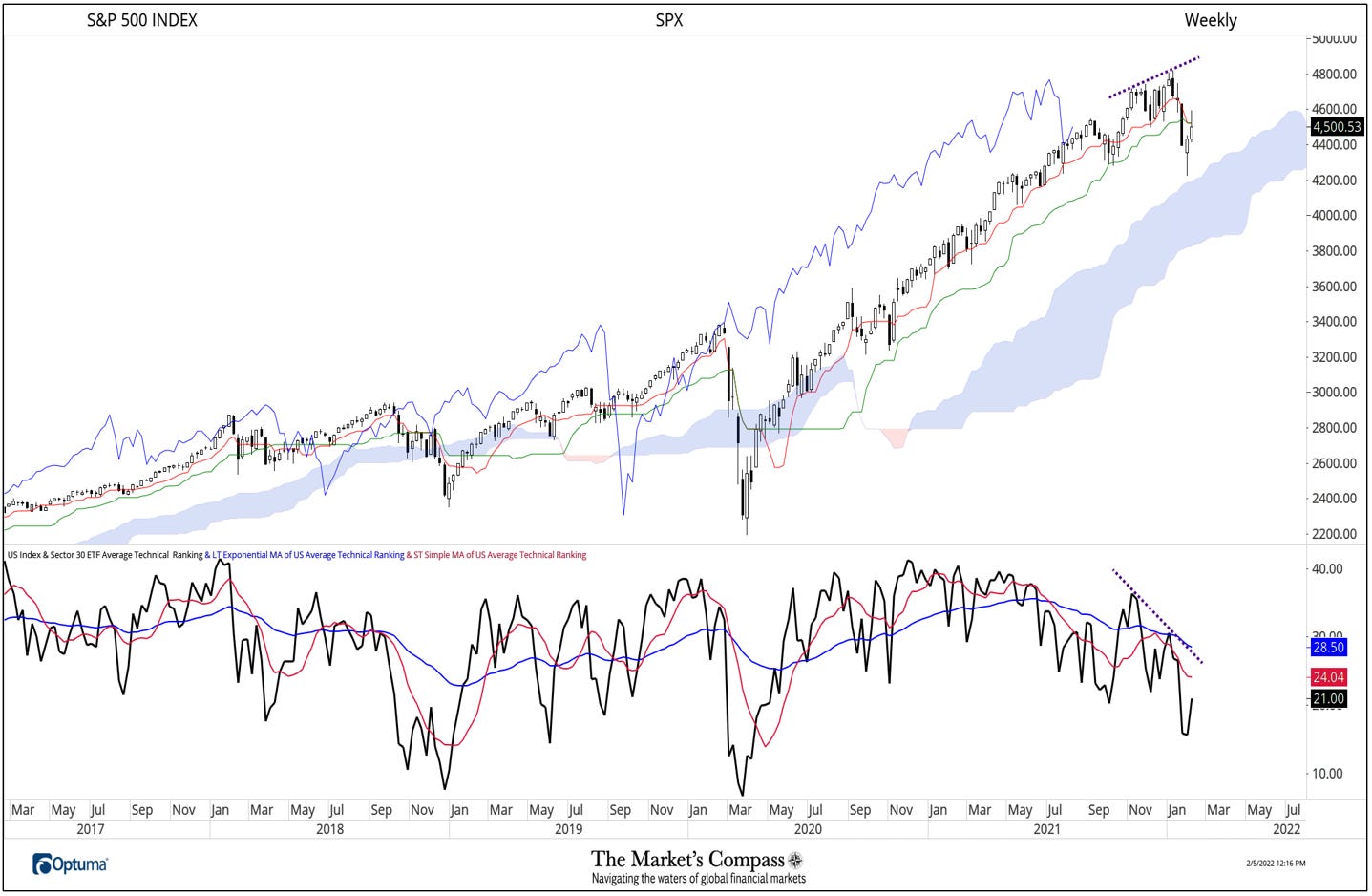

This Week’s and 8 Week Trailing Technical Rankings of Individual ETFs

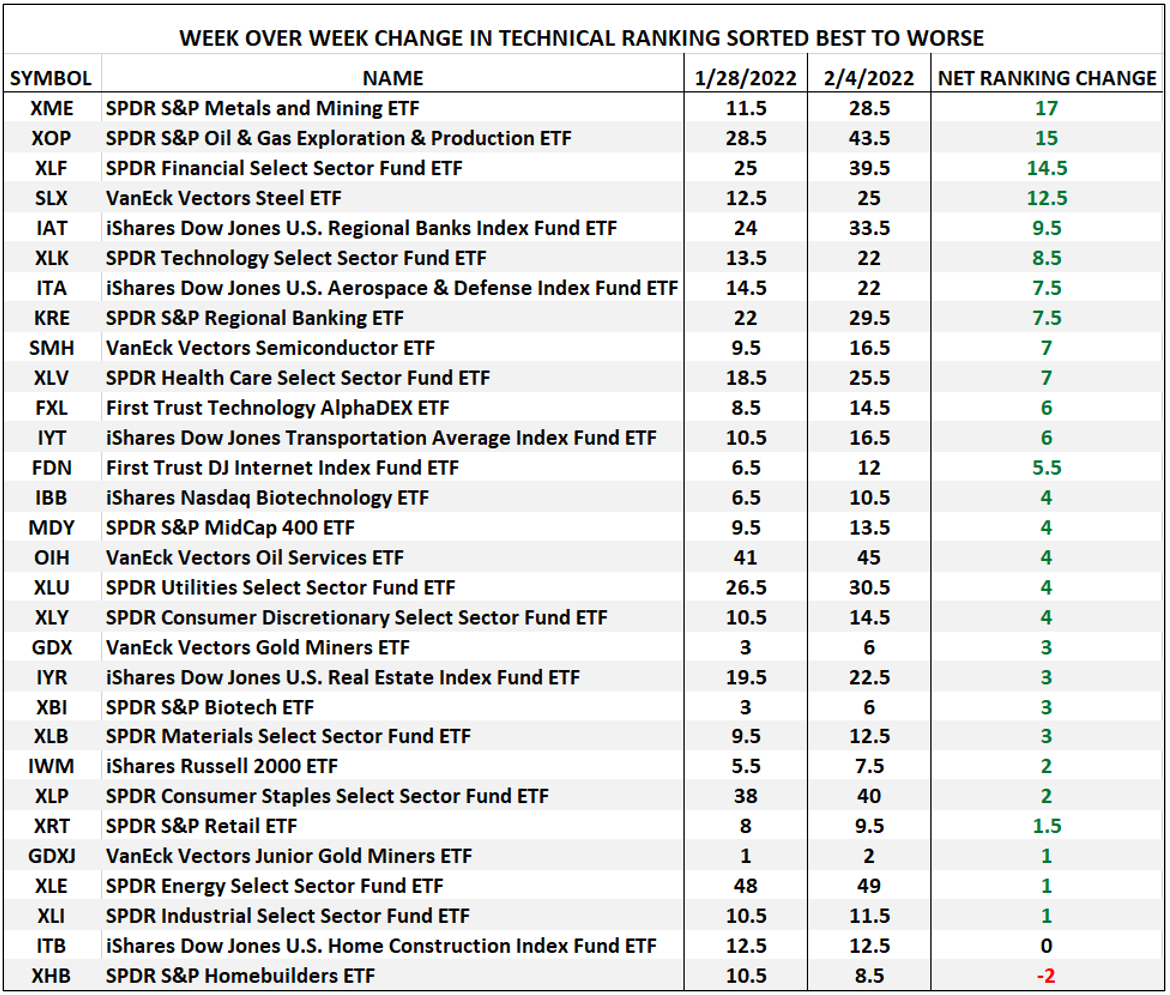

The Excel spreadsheet below indicates the weekly change in the Technical Ranking (“TR”) of each individual ETF. The technical ranking or scoring system is an entirely quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. If an individual ETFs technical condition improves the Technical “TR” rises and conversely if the technical condition continues to deteriorate the “TR” falls. The “TR” of each individual ETF ranges from 0 to 50. The primary take away from this spread sheet should be the trend of the individual “TRs” either the continued improvement or deterioration, as well as a change in direction. Secondarily a very low ranking can signal an oversold condition and conversely a continued very high number can be viewed as an overbought condition but with due warning, over sold conditions can continue at apace and overbought securities that have exhibited extraordinary momentum can easily become more overbought. A sustained trend change needs to unfold in the “TR” for it to be actionable. The color of a number indicates where the “TR” is where each individual ETF is on a scale of 0-50 with 0-15 in Red, 16-34 in Blue and 35-50 in Green and can be viewed as a heat map.

As can be seen above, since the middle of December, the XLP (SPDR Consumer Staples Select Sector Fund ETF) has sported a “TR” that has consistently been in the upper quartile of the 0-50 range. Also noteworthy, has been the continued positive technical condition of energy ETFs over the past 5 weeks. Since the start of the year, the XLE (SPDR Energy Select Sector Fund ETF) as well as the OIH (VanEck Vectors Oil Services ETF) have shown improvement in their “TRs”.

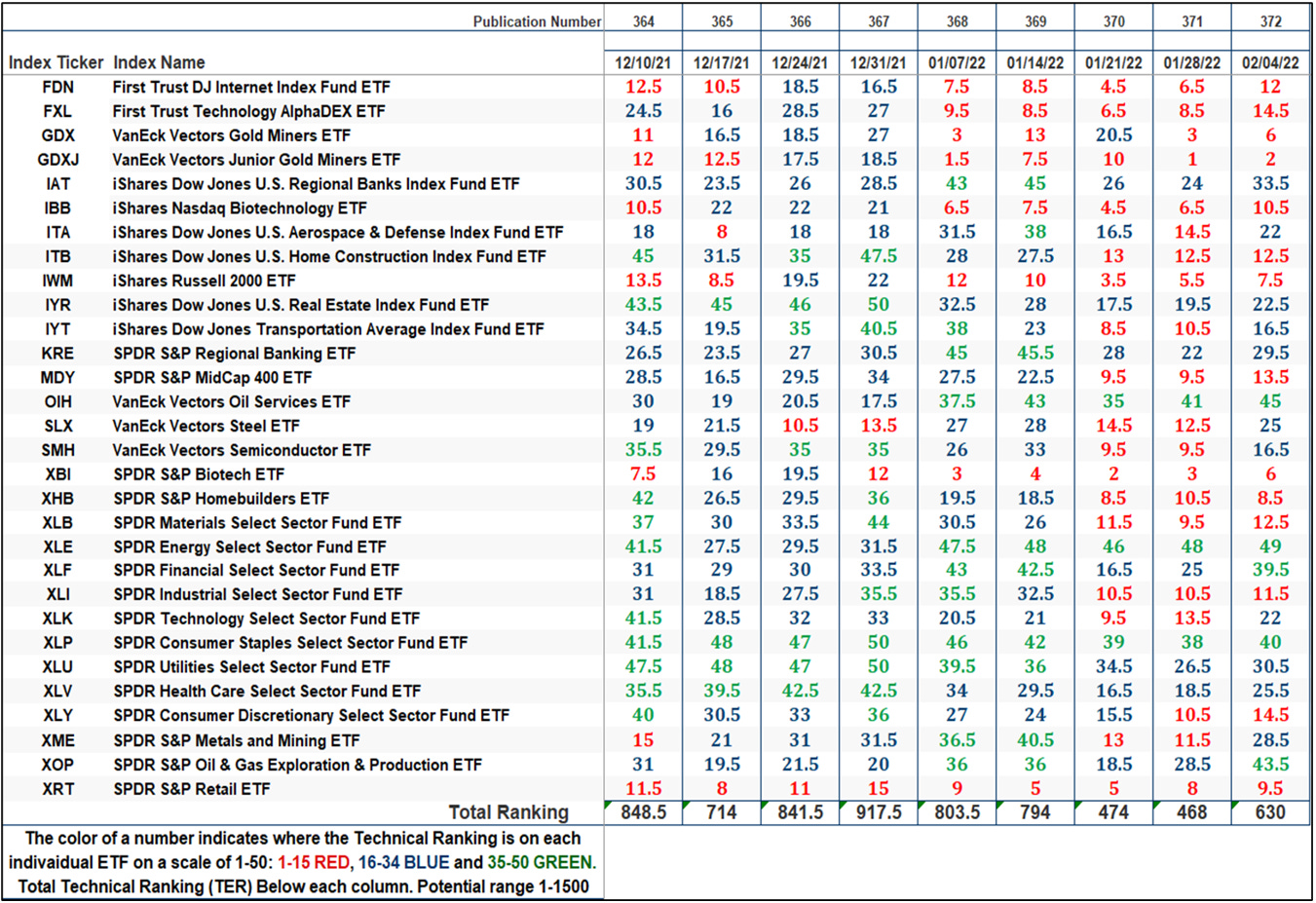

The SPX Index with This Week’s Total ETF Ranking “TER” Overlayed in Blue

The “TER” Indicator is a total of all 30 ETF rankings and can be looked at as a confirmation/divergence indicator as well as an overbought oversold indicator (chart below). As a confirmation/divergence tool: If the broader market as measured by the SPX Index (SP) continues to rally without a commensurate move or higher move in the “TER” the continued rally in the SPX Index becomes increasingly in jeopardy. Conversely, if the SPX Index continues to print lower lows and there is little change or a building improvement in the “TER” a positive divergence is registered. This is, in a fashion, is like a traditional A/D Line. As an overbought/oversold indicator: The closer the “TER” gets to the 1500 level (all 30 ETFs having a “TR” of 50) “things can’t get much better technically” and a growing number individual ETFs have become “stretched” the more of a chance of a pullback in the SPX Index, On the flip side the closer to an extreme low “things can’t get much worse technically” and a growing number of ETFs are “washed out technically” an oversold rally or measurable low is close to be in place. The 13-week exponential moving average in Red smooths the volatile “TR” and analytically is a better indicator of trend.

Although the “TER” registered a 34.62% bounce to 630 from the previous week’s 468 reading, the trend remains lower. Unless the “TER” prints a higher high above the December 31st reading (917.5) the take away is that we can expect that the Friday, October 1st low of 4,388 in the SPX Index to be tested.

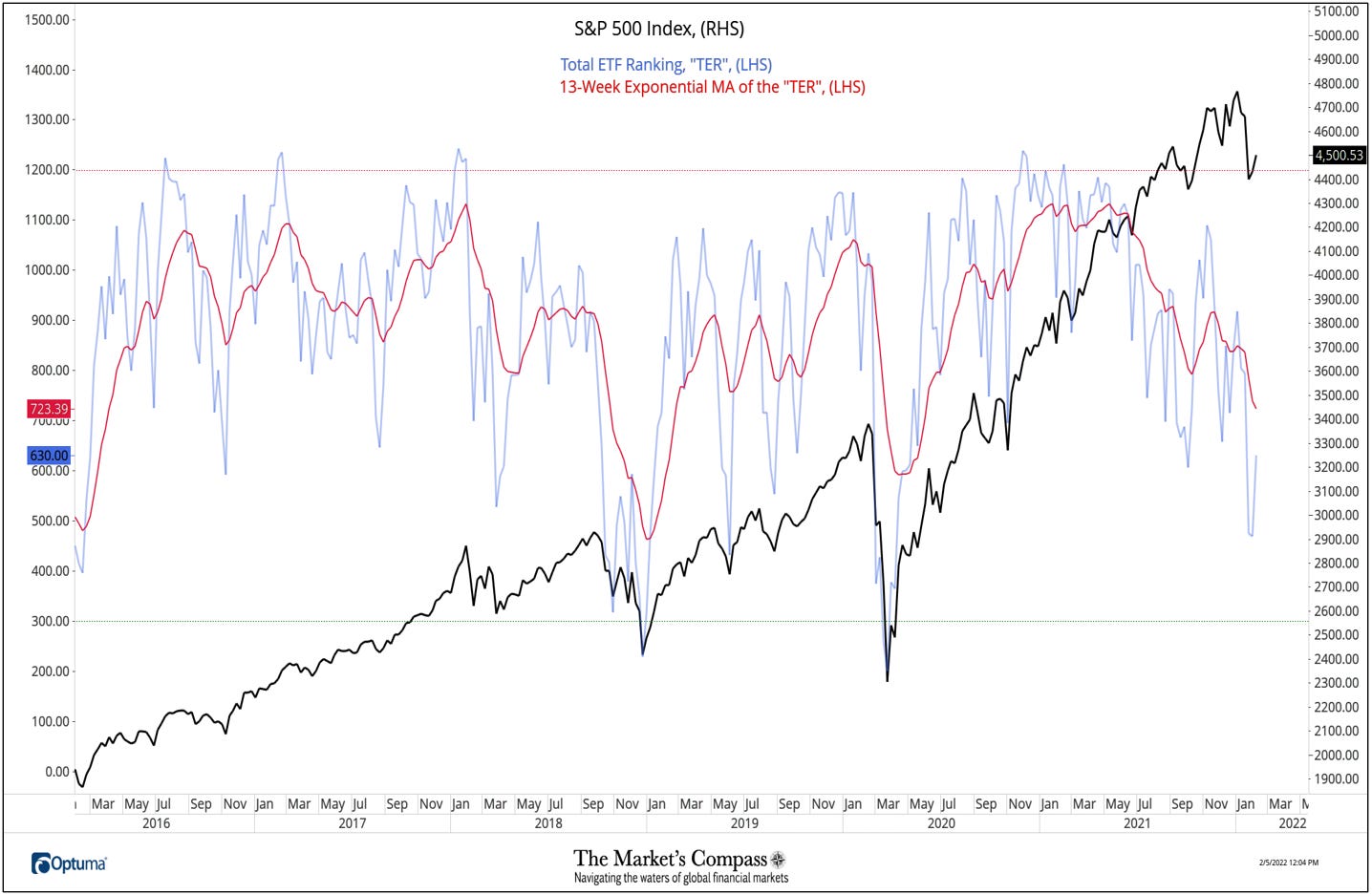

The Average “TR” Ranking of the 30 ETFs

The Average Weekly Technical Ranking (“ATR”) is the average technical ranking of the 30 US Index and Sector ETFs we track weekly and is plotted in the lower panel on the Weekly Candle Chart of the SPX Index presented below. Like the “TER”, it is a confirmation/divergence or overbought/oversold indicator.

The “ATR” printed a divergence (lower high as shown by the violet dashed line) in late December while the large cap index went on to a new high. Also telling was when the short term moving average of the “ATR” (red line) “kissed” the longer term moving average and resumed its decline. Although the “ATR” is tracking lower it has not yet reached an oversold extreme.

The Week Over Week Change in Technical Rankings

After two weekly readings below 15 the XME (SPDR S&P Metals and Mining ETF) “TR” bounced sharply, rising 17 to 28.5 from11.5. The second best week over week “TR” gainer was the XOP (SPDR Oil & Gas Exploration and Production ETF) which jumped 15 to 43.5 from 28.5, rising back up into the upper quartile in concert with a new two year weekly closing high (chart below). Note that MACD of the “TR” (lower panel) has turn up through it’‘s signal line and the momentum oscillator of the “TR” is beginning to track back into positive territory.

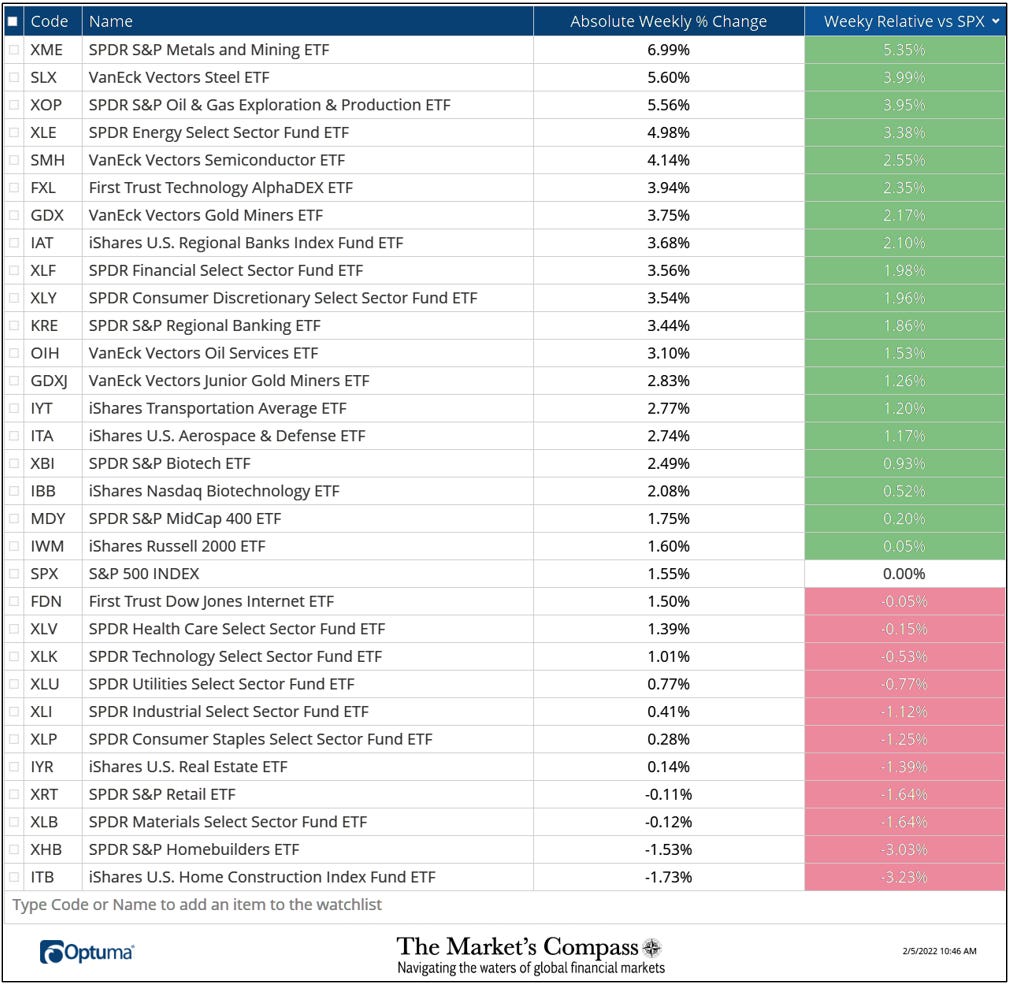

The Weekly Absolute and Relative Price % Change*

*Does not including dividends

The afformentioned XME and XOP ETFs were two of the top three best performing ETFs on an absolute basis up +6 .99% and +5.56% last week. Sandwiched between the two was the SLX (VanEck Vectors Steel ETF) up +5.60%. The top 15 holdings of those three ETFs are shown below. Data is courtesy of Bloomberg.

XME Holdings

XOP Holdings

SLX Holdings

The Relative Return Vs. the SPX Index Year to Date*

*Does not including dividends

I invite our readers to contact me with any questions or comments at…tbrackett@themarkets compass.com

[ad_2]

Source link